Capitalizing on Rwanda’s Fintech Potential: Insights into a Rapidly Evolving Sector

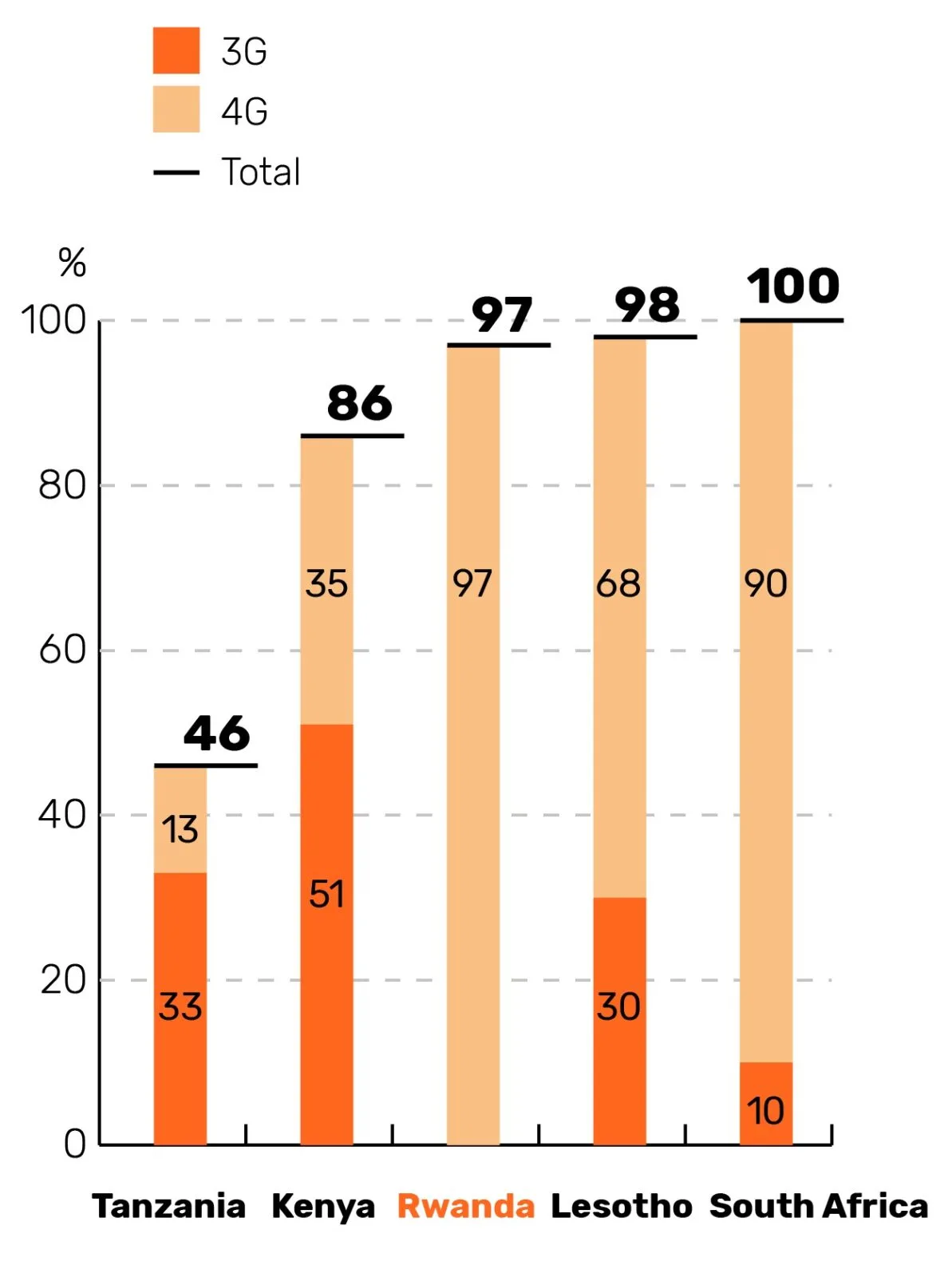

Network coverage

Rwanda’s fintech sector is rapidly gaining momentum, fueled by high mobile money adoption, forward-thinking regulation, and a government committed to digital transformation. With 4G coverage reaching 96.6% and internet bandwidth increasing tenfold between 2015 and 2019, the country has laid a solid digital foundation. A 7,000 km national fibre optic backbone further strengthens connectivity, positioning Rwanda as a regional leader in financial innovation.

Government of Rwanda ambitions for fintech

The Government of Rwanda aims to establish the country as a regional financial hub. Through initiatives like the Kigali International Financial Center (KIFC), the government seeks to boost Rwanda’s competitiveness in global finance and attract international investment.

To support fintech growth, the government has introduced regulatory tools such as sandbox frameworks that enable controlled testing of innovative solutions.

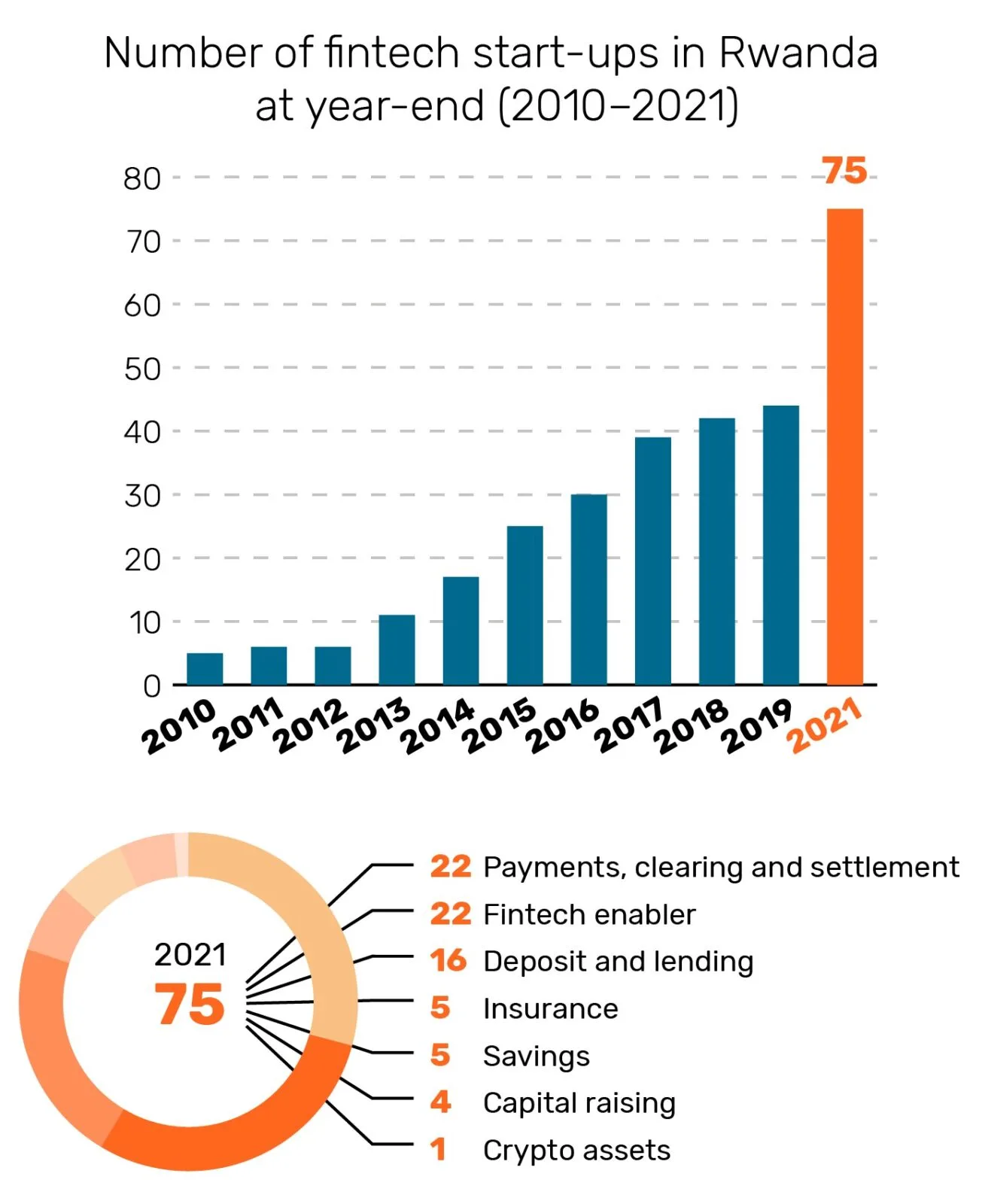

Fintech start-ups

National strategies like the Financial Inclusion Strategy, Payment System Strategy, and Vision 2050 guide the country’s digital and innovation agendas.

Rwanda also offers several incentives to attract ICT and fintech investors such as, 15% preferential corporate income tax for registered ICT investors, VAT refunds for ICT materials, up to 5-year tax holiday for licensed microfinance institutions and capital gains tax exemption on primary equity share sales (up to $500K)

Fintech companies introducing innovative products can apply for a regulatory sandbox license from the National Bank of Rwanda, with guidelines developed in collaboration with RURA.

Potential fintech service domains to be explored in Rwanda

Rwanda’s fintech sector spans various service domains, each with its own players, customer segments, and regulatory dynamics. From payments and lending to digital banking and insurtech, each domain presents unique opportunities and challenges for growth and innovation.

The Netherlands & Rwanda in Fintech

The Netherlands is globally recognized as a fintech hub, driven by innovation from both start-ups and established financial institutions. Several Dutch fintech companies are already active in Rwanda, and TRAIDE continues to foster partnerships between Dutch and Rwandan businesses to identify scalable opportunities for collaboration and inclusive innovation. We believe the Dutch and Rwandan private sectors can play a catalytic role in shaping Rwanda’s fintech journey.

–> Download Rwanda Fintech Factsheet <–

Interested in Exploring Rwanda’s Fintech Sector?

If you are an investor looking to enter Rwanda’s fintech market, reach out TRAIDE can support you with market insights and explore impactful partnerships. You can reach us at info@traide.org.